The hectic fourth quarter for US private jet transactions is becoming even busier with the news that 100% bonus depreciation will drop to 80% from January 1st 2023. But the rush to close deals ahead of the deadline could lead some buyers to skip due diligence, such as pre-purchase inspections (PPI), according to brokers consulted by Corporate Jet Investor.

“As this is the last year of 100% tax depreciation in the USA, people are taking advantage [to complete sales], Oliver Stone, MD, Colibri Aircraft, told CJI. “Those tax incentives will keep demand stable over the end of this year. However, we are seeing increasing levels of inventory in the marketplace at the same time (up 27% since the lows of March), so all bets are off starting 2023 when the combination of reduced tax benefits, sated short term demand, rising interest rates and increasing inventory comes into play. We are expecting a good Q4 and an interesting 2023.”

Strong US corporate profits was also helping to drive US demand but demand for pre-owned jets in Europe was a lot slower than across the Atlantic, he added. Further, most USA based buyers are focused on USA based aircraft due to simplicity of transaction structure and so for many European sellers this USA based demand may not directly benefit them.

Jay Mesinger, CEO and president, Mesinger Jet Sales told us the change from 100% depreciation to 80% depreciation next year “is not big in the grand scheme of things”.

He added: “The past two years have been crazy [for the high number of aircraft transactions]. Last year and the year before both saw a shortage of supply.”

While pre-owned transactions are slowing, it was unclear why, he said. “We’re already seeing a slow down. We have to determine if slower/fewer sales in Q4 will be because of less demand or less supply.” Fourth quarter sales will be a strong indicator of transactions in the first quarter of next year, he added.

Nevertheless, he remained excited about the prospects for the remainder of this year and the start of 2023.

Both brokers consulted by CJI said the rush to complete deals next quarter will tempt some buyers to miss out PPI inspections. In fact, Mesinger said some prospective buyers have skipped inspections for some time. “Last year there was also a reduction in buyers demanding PPI,” he said. “There is a question of whether buyers are willing to ignore traditional due-diligence of getting PPIs in favour of lighter PPIs in hangars.”

Colibri Aircraft boss Stone told us the industry is already experiencing “a severe capacity crunch [for aircraft inspections] and this will continue”.

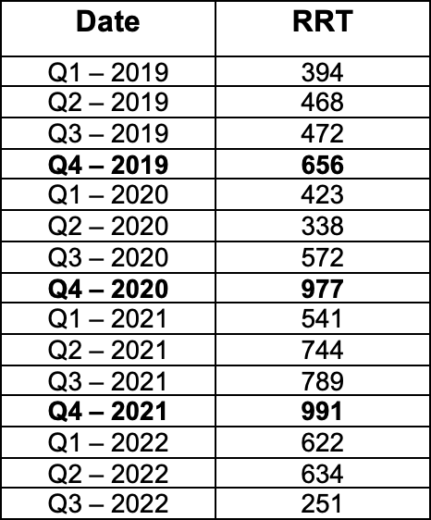

Resale Retail Transactions (RRT) – at a glance

Summary (Year:Total RRT):

- 2019: 1,334

- 2020: 1,333

- 2021: 2,074

- 2022: 1,507

Source: AMSTAT.