Jetcraft’s latest transaction data reveals large jets (Bombardier Global, Dassault Falcon 7x, Gulfstream G500, etc.) account for a major share of aircraft purchased by buyers under 50 years of age. The US-based firm published the findings in its Five-year Preowned Market Forecast, highlighting that interest from the younger generation of buyers offers long term growth potential for business aviation. “We predict these young, UHNWI, large aircraft buyers will transition to become early adopters in new industry innovations, such as sustainable aviation fuel, supersonic jets and electric aircraft,” the company said.

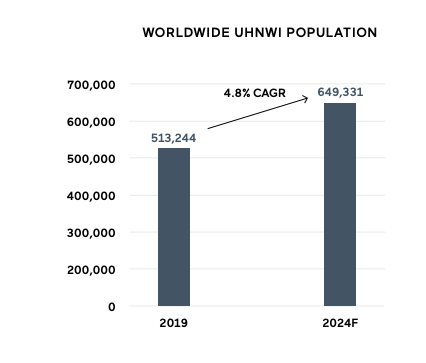

Jetcraft also predicts long term growth in the large jets segment due to globalised economies and an increase in UHNWIs. According to its report the number of UHNWIs is set to grow by almost 5% a year until 2024. “This population is a key driver in business aviation activity, demonstrating strong growth prospects for the industry. Further, the addition of new platforms – building on existing charter, fractional and block hour solutions among others – continue to make business aviation more accessible.”

The health of activity in charter and fractional programmes is a good sign for future investment in aircraft beyond 2020, Jetcraft President Chad Anderson told CJI Americas delegates this week.

“The numbers that we are seeing and hearing right now [in charter] is absolutely the seed that plants and becomes a bigger airplane or a whole airplane down the road. It’s like the saying ‘dipping your toe in the water’; it’s an opportunity for clients and buyers to realise the real benefits of business aviation,” said Anderson.

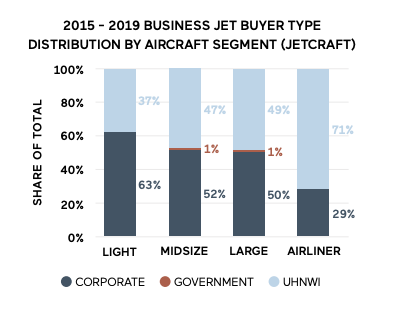

Looking at the split between UHNWIs, government and corporate buyers within Jetcraft transaction data over the past five years, UHNWIs represent a higher share of buyers as aircraft size increases. This may be due in part to some corporations avoiding larger jets because of shareholder and public scrutiny.

Jetcraft noted that despite trade wars and the rise of nationalism across the world, international trade has shown resilience over the past decade. While Covid-19 has temporarily reduced trade activity, the World Trade Organization WTO projects trade volume will rebound in 2021.

In light of this Jetcraft forecast, pre-owned transaction volume and value will recover to steady growth during the forecast period, reaching 2,271 transactions worth $11.1bn annually by 2024. The number of large jet transactions will increase over the next five years, albeit at a slower pace compared with previous years. Whilst the average annual pre-owned transaction value has seen its lowest point in 2020 and will rebound, remaining stable over the next five year.

Jahid Fazal-Karim, board chairman, Jetcraft said: “This year, we’ve opted to focus our predictions solely on the pre-owned market, an area that isn’t often included in other industry outlooks and which is a particular strength of ours. Moreover, for the first time, our forecast is enriched by the introduction of trends from our own past transactional data and customer insights.

“Our previous forecasts predicted a downturn. Although it has taken place sooner than we thought, we were prepared and, as a result, are in a stronger position than in 2008. Aviation is one of the most dynamic and resilient industries in the world and I’m confident in its post-Covid-19 recovery, particularly with more first-time buyers realising the value of business aviation.”