- What an influx of new capital means for business aviation

- How ‘irrational’ capital can be lured by the ‘glamour’ of aviation

- The impact on smaller operators, driving consolidation

- How this dynamic will also drive innovation in the sector

An influx of new capital into the business aviation market in recent years has caused deep and profound changes to the industry. This could lead to more innovation but also increases pressure on smaller operators.

Those were some of the key messages from Kenn Ricci, Principal, Directional Aviation, speaking at Corporate Jet Investor Miami (31 Oct – 2 Nov, 2022) in a presentation called ‘How the inflex of new capital is reshaping business aviation’.

He said that the number of private aircraft available for non-scheduled commercial operations has increased by 25 percent since 2016 – yet, at the same time, the number of operators has declined.

He noted that the average fleet size per operator grew from 11.4 to 15.7 aircraft in that period and the number of operators with more than 80 aircraft climbed from two in 2017 to seven. He said the biggest five operators (NetJets, Flexjet, Vista Jet, Wheels Up, and Jet Linx) now control more than a third of the private jet fleet.

This growth has largely been driven by more investment in the industry, Ricci said, noting that this also means that larger operators can now compete with airlines to attract and retain pilots. As bigger companies, they can also offer stability to employees and certainty to customers, offering a more anonymous option for high-profile individuals wary of being “flight shamed.”

He noted that many of the pilots recruited by the large business jet operators come from commuter airlines. “That trickles down and creates a challenge for the smaller operators as to where they get their pilots from. It exacerbates the problem, because the larger operators continue to grow their fleet,” he said.

Ricci predicts the economies of scale leverage enjoyed by the large operators will continue to put pressure on the smaller operators.

He offered an insight into the nature of some of the new money entering the industry. He claimed that more than 90 private aviation aircraft operating companies are now backed by private equity. He also highlighted the scale of some of these investments with six private equity transactions worth in excess of $400 million. “We’re at a whole different level of the amount of capital that’s been infused into the industry,” he said.

He accepted that some of the capital in the business was attracted because of the “glamour” of aviation and he also admitted some of it may be irrational. Yet that can also drive innovation. “When capital starts looking for an opportunity, suddenly, we start having different products. We invent a new products and products expand. And, of course, to fulfil the product expansion, we then have fleet expansion.”

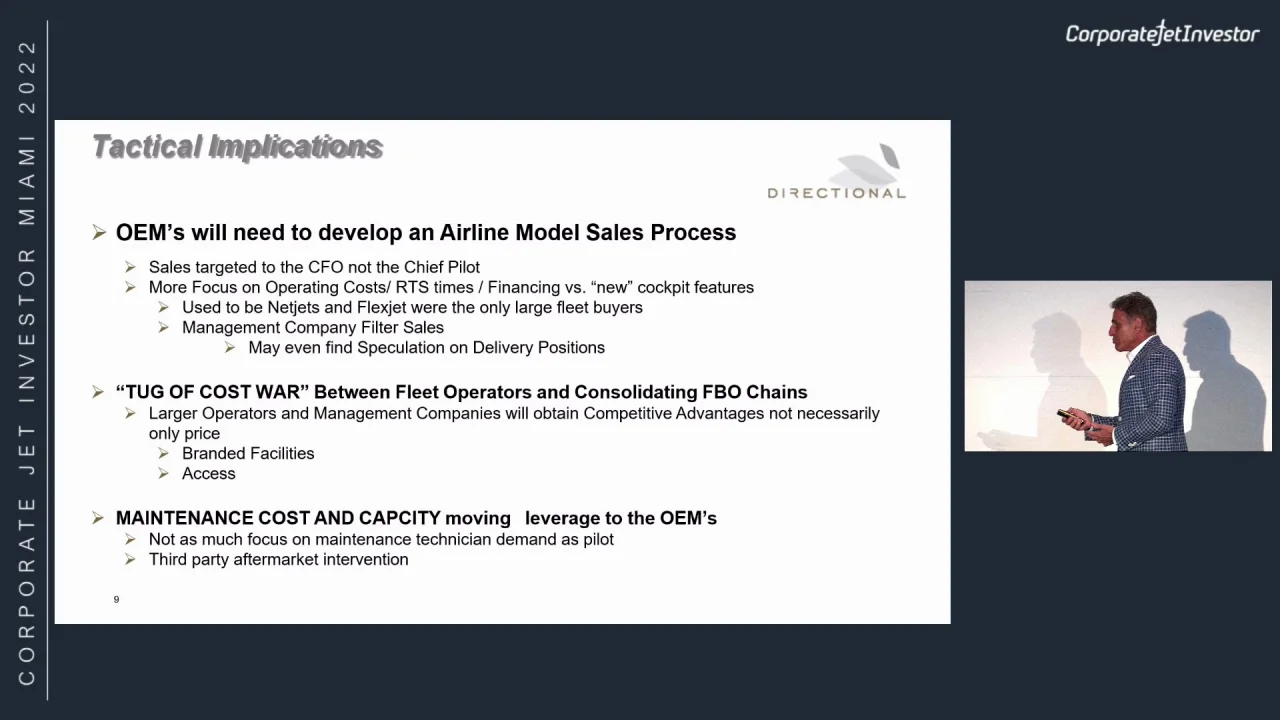

He said a different model will also start to emerge as all parts of the business, from manufacturers to OEMs, start to think about selling differently. “It creates just a different model, a go to market model.”

He concluded: “There’s a lot of great ideas. Well, there’s a lot of ideas that come to private aviation that we know are not executable, but people fund them anyhow because it’s glamorous. But that the capital will move from irrational to rational eventually, which will put the brakes on some of the growth that’s happening out there.”

Corporate Jet Investor Miami 2023 takes place on November 6th-8th